PRIVATE WEALTH

We bring contemporary thinking to the architecture of investments

and assets to support our clients goals and objectives.

Established in 2009 as a Swiss-based global wealth manager, Pilotage is a pioneer in serving the investment, wealth and banking needs of US citizens living abroad, US residents’ offshore requirements and Global cross border clients.

In parallel to our partnered clients, we have grown globally, beyond borders, with bespoke strategies to enhance, protect and transfer wealth - preparing our clients for the future and what it might bring.

-

Our consultative process comprises of performance analysis & benchmarking, risk evaluation & budgeting, asset allocation attribution & contribution and built in portfolio protection - all in the context of achieving alignment with our clients goals and values. With a razor sharp focus on global risk adjusted returns we bring a contemporary perspective to investment design.

-

Looking into the future of our client’s path, together we seek to optimize tax & cash flow enhancement, efficient transfers of wealth, effective use of protection & risk mitigation and developing sustainable philanthropic and foundation objectives. Our clients can choose from a leading selection insurance, trusts and corporate instruments to conserve and compound their wealth.

-

Synonymous with Swiss quality, we strive to provide excellent service to our valued clients. Instead of the conventional relationship manager, our clients benefit from their own Pilotage dedicated team - benefiting from a range of experience and focus. Our diversified careers allow our clients to leverage our professional experience and benefit from the relationships within our expert network.

WEALTH

MANAGEMENT

-

We manage discretionary and advisory investment mandates tailored to our clients specifications, our breadth includes global multi asset class, multi currency strategies to focused regional exposures. The foundation of our Investment Philosophy is rooted in strategic allocation, market factor premias, diversification and risk management.

-

Applying the latest technology in portfolio management systems, including order management and reporting systems, Pilotage’s platform has cutting edge tools to ensure insight and precision on the administration of our client’s global assets. Our platform provides our clients with institutional class tools combined with global accessibility.

-

The Pilotage platform can serve as the central resource for our clients to oversee third party managers including private & illiquid investments , assets and liabilities. Or alternatively, serve as an extension to our client’s existing resource and organization. With centralized clear line of sight, our clients gain a better perspective of what’s ahead.

ASSET

MANAGEMENT

CUSTODY MANAGEMENT

-

Confidentiality and privacy is a core tenant to our values. From the foundation up, we designed our operating environment to protect our client’s data and information to the highest standards of FADP, GDRP and FinSA. Our clients benefit from the security of our Swiss based IT infrastructure without compromising innovation.

-

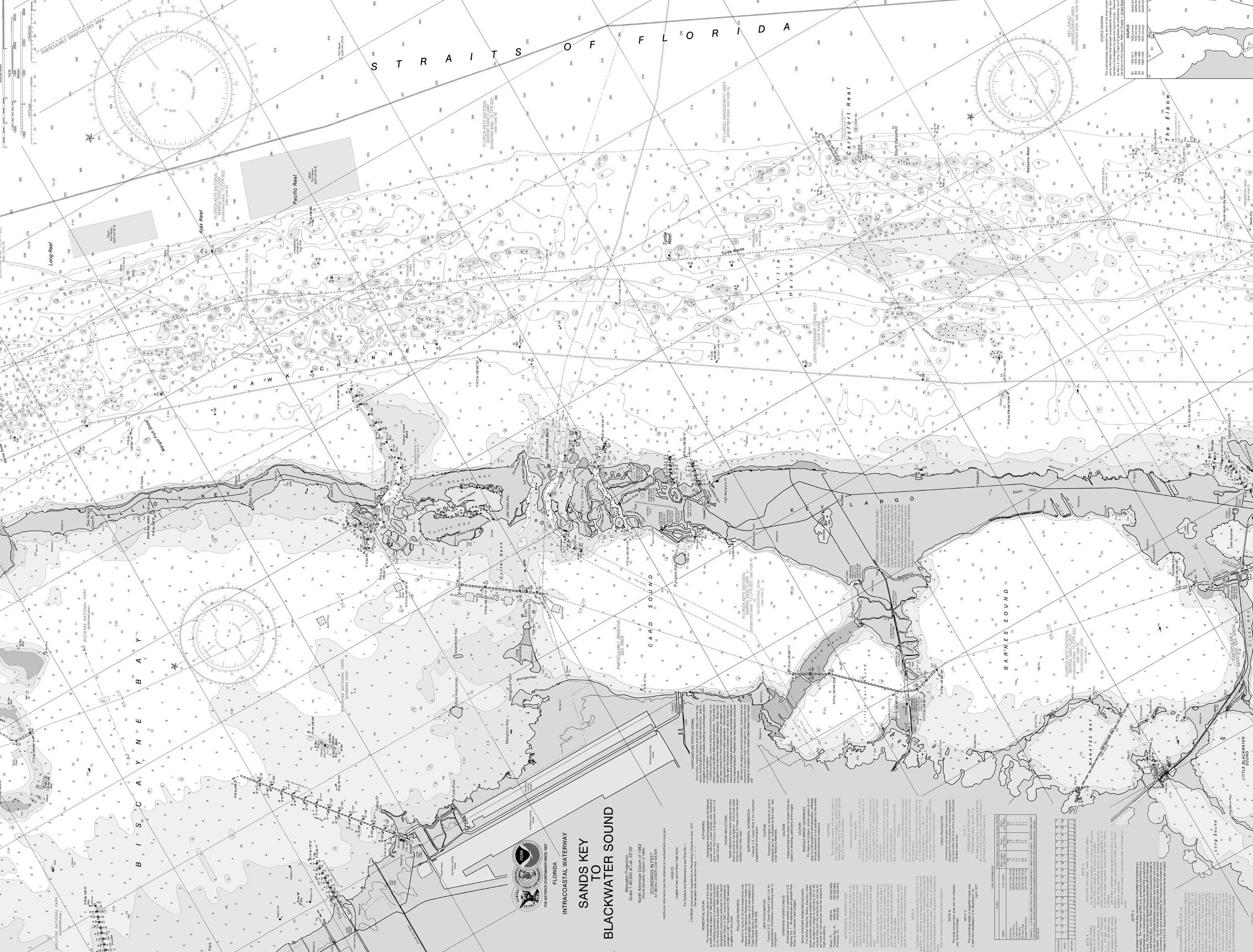

As one of the first SEC registered Swiss asset managers regulated by ARIF, we have set standards for charting new waters in the multi-jurisdiction and regulatory world. With a keen eye on detail we manage and administer the compliance, risk, legal and operational specifications of our clients custodians, banks and brokers.

-

Our platform includes leading prestigious Swiss Private Banks, EU booking centers and US investment accounts - consolidated into a simple and centralized access point. Whether multi-currency, multi-asset class, exotic, traditional or corporate assets and liabilities - our clients can access transparent and clear line of vision.

Financial Planning

Globally minded wealthy families are sophisticated with their financial requirements. Convention does not apply. We bring contemporary thinking to the architecture of investments and assets to support our clients goals and objectives.

Career Mobility

We believe opportunities do not have borders. Americans living in Switzerland or Europeans relocating to the US, rely on our specialists from realigning their pension strategies to streamlining reporting requirements on their income and assets.

Tax Advantaged

Spanning generations, our clients are not defined by borders and seek to simplify the complexities of international tax. Going further, we design tax advantaged strategies to enrich our client’s lifestyles and benefit global tax synchronization.

Charting Legacy

Composed stewardship will lead accomplished families through the complexities of domestic and global events. We provide the guidance and the tools to our clients so that they may preserve the values of their patrimony and promote their vision.

Asset Protection

Success and opportunities are paired with risk and exposure. Not only do we apply the highest standards of confidentially and privacy, we develop advanced structures and instruments to preserve and protect our clients wealth.

Asset Diversification

With a firm understanding of the world, high performing families require a dimensional approach to diversification from asset location to counterparty risks. As their guides, we aim to enhance their global purchasing power while controlling risk.

Download our Form CRS